Customers of our solutions benefit from updates every year, allowing them to benefit from new Odoo features but also from features added to our roadmaps based on our customers'requests.

In the past, we added the CODA mode, which allowed our customers to download CODAs from Isabel automatically, with the advantages that this brings: detail in transactions, control over balances by comparing those of the CODA with those in Odoo, tracking reference numbers, etc.

This month we are working on new improvements to further improve our customers' productivity.

Customer productivity as a mission

We already described it on a dedicated webpage and we repeat it at every occasion: our mission is to increase the productivity of our clients - through digital transformation.

We have been developing Isabel Connect for a few years now and it is a nice showcase of our mission. Thanks to the automation it allows, our clients save up to one hour of work per day!

This month we are staying the course and moving forward on three topics that will support the increase in productivity among our customers.

The reauthentication flow

Unlike what Odoo requires off the shelf with the PSD2 standard, with Isabel Connect it is not necessary to reconnect to your banks every 3 to 6 months. On the contrary, our solution allows us to only ask our customers to re-authenticate to Isabel once a year. That is once every twelve months for all connected bank accounts.

In the next version of Isabel Connect, we are improving the process related to this exercise to make it even simpler.

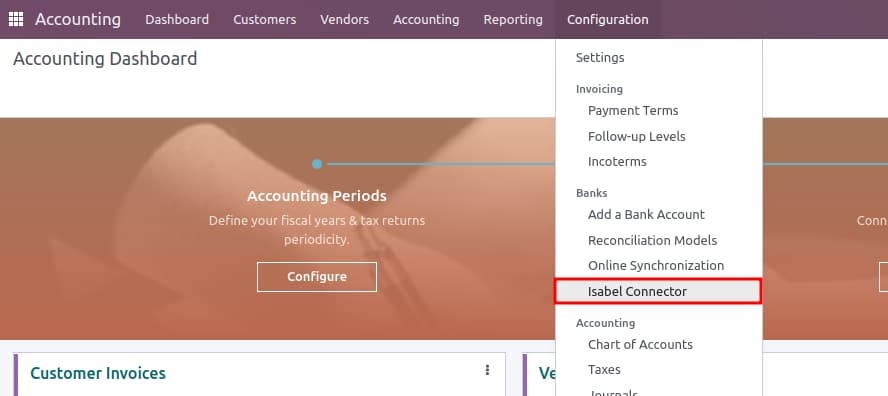

The configuration menu will be moved to the accounting module, thus avoiding the need to obtain administrator rights to access the solution settings. However, only people with accounting access will be able to see them.

The re-authentication message also becomes more explicit and an indication that the process has been successfully completed helps ensure that everything is working correctly.

Finally, a re-authentication guide has been completely rewritten to make your job even easier.

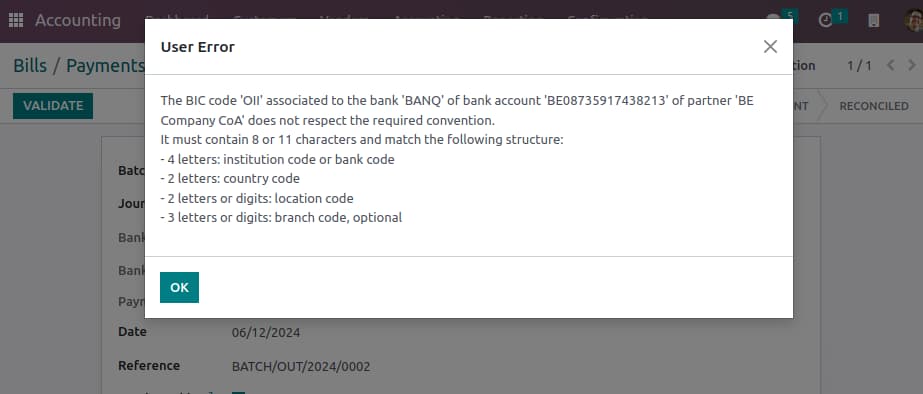

Control in payment files

Many customers experience quality issues in their data. This comes from human errors or oversights, or even hasty typing. The new version will allow SEPA files to be validated in Odoo before sending to Isabel. This will have the advantage of noticing the error before the file exchange, which will simplify the flow and speed up data correction.

Moreover, to go further in improving the quality of your data, go to the page of our latest solution: Smart Governance, a module installed on Odoo which will allow you to regain control over your data.

Automated notification

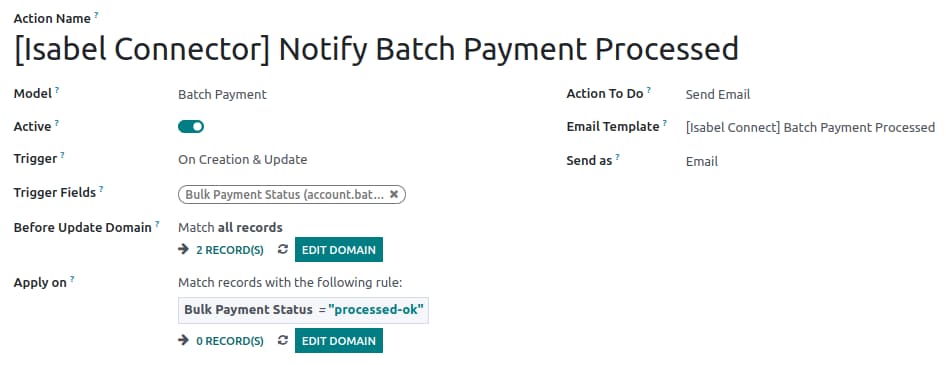

Also originating from a customer request, we are adding to Isabel Connect the possibility of automatically sending a notification to the person who must sign a payment once the SEPA file has arrived on Isabel 6.

Very often, the person preparing the payments is a different person than the one signing them for execution. Today, when a payment is sent to Isabel, the person who prepared it must notify the signatory manually. This generally happens via an email (with a PDF printout of the payment attached) or a “tag” in Odoo which triggers a notification. This last action for the person preparing the file will therefore no longer be necessary since Isabel Connect will automatically send the notification to the person concerned.

Availability

This new version of Isabel Connect will be available to all our customers using Odoo 16 or 17, from the end of June. To learn more about Isabel Connect, join us for a free demo webinar.

New features in Isabel Connect: even more productivity